- Are you tired of depending only on your salary or business earnings to secure your financial future? Are you looking for ways to effortlessly grow your income? Well, you’re not alone. Many savvy individuals, like yourself, have discovered the secret to building wealth by using income generating assets.

- According to a report by Jefferies, Indian households held 66% of their assets in real estate and gold, with real estate accounting for 51% and gold for 15%. This highlights the enduring popularity of real estate as a safe investment option in India, given its tangible nature.

- But real estate isn’t the only option for growing your wealth. There are other kinds of income generating assets that can provide you with more diversification and potentially higher returns.

- By exploring different types of assets like stocks, bonds, dividend-paying stocks, savings accounts, and peer-to-peer lending, you can expand your investment portfolio and increase your chances of becoming financially independent.

- In this article, we’ll guide you through the world of income generating assets and show you how they can help you reach your financial goals.

What are Income Generating Assets?

- A resource that is expected to increase in economic value over time is generally referred to as an asset. It may or may not provide a steady source of income.

- However, assets that generate income are those that are purchased with the goal of gradually producing a steady stream of cash flow and return on investment .Examples of income generating assets include stocks, bonds, Real estate, dividend-paying stocks, interest bearing savings accounts, and peer-to-peer lending investments. These assets can provide a source of passive income and help you build wealth over time.

- The capacity of these assets to produce steady, consistent income over an extended period of time makes them appealing. Even though completely passive investments are rare, income-producing assets frequently call for medium- to low levels of involvement. As a result, the investment type selected will determine the time frame and potential returns.

Top 8 Income-Generating Assets to Invest in India

Interest from bank deposits

Bank deposits are a simple and secure way to generate passive income. There are various types of bank deposits that offer interest earnings to investors.

- Savings Account: Savings accounts are probably the most common form of a bank deposit. By opening a savings account, you can deposit money to your account, and the bank will provide you with interest on that deposit. You can withdraw this money instantly and use it when needed. Interest rates for savings accounts are typically lower compared to that of fixed deposits ranging from 2.5- 3.25%

- Fixed Deposit (FD): Fixed deposits are ideal for people with a lump sum amount of money that they don’t need to access right away. When you deposit the amount, you agree to lock the funds away for a specific duration, which could be anywhere from a few months to a few years. During this time, your money earns a higher rate of interest compared to a savings account. The longer you’re willing to keep your money in the fixed deposit, the higher the interest rate that you can receive. The interest rate for fixed deposits can vary between 6% to 7%. One thing to be aware of is that if you withdraw your money before the end of the fixed deposit duration, you’ll incur a penalty.

- Recurring Deposit (RD): These deposits are perfect for individuals looking to make small monthly investments. With no pressure to invest a lump sum upfront, you can conveniently deposit money at regular intervals, usually every month, until the end of the term. The recurring deposit plan earns interest at rates similar to that of a fixed deposit. The minimum investment amount required is generally low, making it an ideal option for people who can only save small amounts of money every month.

Retirement schemes

Pension plans are financial products specifically designed for senior citizens to secure a steady income during their retirement years. These plans are structured to provide regular payouts, which can be received on a yearly, half-yearly, or monthly basis, depending on the preferences of the investor.

When investing in pension plans, you can expect to earn a return on their investment. The typical range for annual returns on these plans is between 6% to 7.5%, offering a stable and predictable income stream for retirees. It’s important to note that the actual return may vary based on the specific plan chosen and market conditions.

- One popular pension plan available in India is the Pradhan Mantri Vaya Vandana Yojana (PMVVY) offered by the Life Insurance Corporation of India (LIC). This plan provides a competitive annual interest rate of 7.4%. It offers senior citizens a reliable income source and helps them meet their financial needs during their post-retirement years.

Pension plans are considered attractive investment options for retirees as they provide regular income without the need for active management. By choosing a pension plan that suits your financial goals and risk appetite, senior citizens can enjoy a stable income stream and financial security during their retirement.

Real estate

Real estate investment has been a popular choice, particularly among previous generations.

Investing in real estate, whether in residential or commercial properties, offers the dual benefit of earning rental income regularly and enjoying capital appreciation over time. In the Indian market, rental yields typically range from 2% to 3%, representing the income generated from the property as a percentage of its total value.

On the other hand, the average rate of capital appreciation, which reflects the increase in the property’s market value, hovers around 8% over time.

However, managing physical properties can be demanding and requires time and effort. For investors seeking a more convenient approach to real estate investment, fractional ownership of real estate is an attractive option.

Fractional ownership Real estate

Fractional ownership allows individuals to pool their resources with other investors to collectively own a property. This can be done through specialized platforms like Assetmonk, that facilitate fractional ownership arrangements. It provides investors with the opportunity to enjoy the benefits of real estate ownership, such as rental income and potential appreciation, without the burdensome responsibilities of property management. You can start investing at just Rs. 25 lakhs.

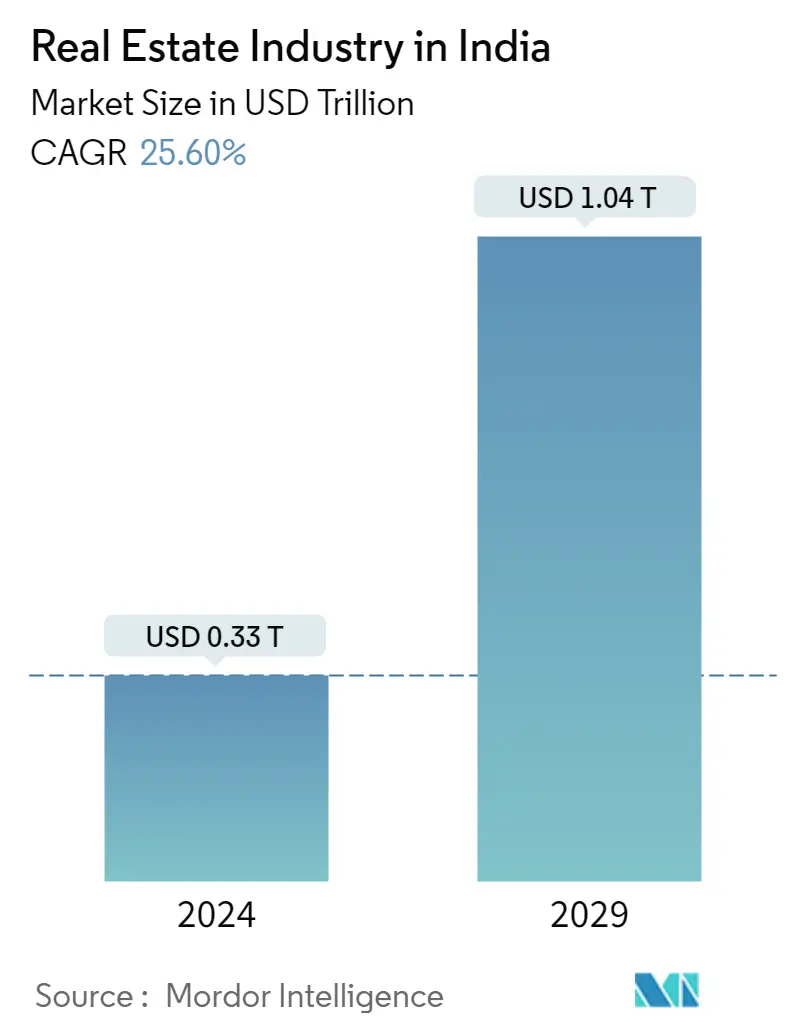

Knight Frank predicts that the fractional ownership real estate market in India will experience significant growth in 2024. This growth will continue from the momentum seen in 2023. In 2020, the size of the fractional ownership market was around USD 5.4 billion. However, it is projected to reach USD 8.9 billion by 2024, according to Knight Frank’s forecast.

The trend has been influenced by several factors, such as higher prices making premium properties less affordable, evolving lifestyles and investment preferences, convenient tech-enabled user experiences, and the increasing availability of start-ups and investment platforms.

Peer-to-peer lending

Peer-to-Peer (P2P) lending is a financial innovation that enables individual investors to play the role of a lender, similar to a traditional bank, by providing loans directly to borrowers. This form of lending occurs through online platforms that facilitate the connection between investors and borrowers.

One of the key advantages of P2P lending is the potential to generate a regular income stream. Retail investors who participate in P2P lending can earn attractive annual returns, typically ranging from 5% to 7%. These returns are earned in the form of interest payments made by the borrowers on the principal amount lent.

However, it is important to note that P2P lending is not without risks. One significant risk associated with this type of investment is counterparty risk. Counterparty risk refers to the likelihood that the borrower may default on their loan obligation and fail to repay the principal and interest to the lender. This risk arises due to various factors such as the borrower’s financial situation, creditworthiness, and ability to fulfill their contractual obligations.

Stocks paying dividends

Stocks represent ownership in a business and offer potential income through price appreciation and dividend payouts. When you invest in stocks, you essentially become a partial owner of the company. As the company grows and the value of its shares increases, you can benefit from price appreciation when you sell your shares at a higher price than what you initially paid for them.

Dividend payouts, on the other hand, are periodic distributions of a company’s earnings to its shareholders. These dividends are typically paid in cash or additional shares and are based on the company’s profitability and its decision to distribute a portion of its earnings among shareholders. Dividend-paying stocks can provide a predictable income stream, making them a popular choice for income-focused investors.

In the Indian market, there are several dividend stocks that have shown strong capital appreciation and have consistently paid dividends. Here are a few examples:

- GAIL (India) Ltd has a dividend yield of 7.44% and has delivered an average return of 13.93% over the past five years.

- Hindustan Zinc Ltd. offers a dividend yield of 5.98%, along with a five-year average return on investment of 22.72%.

For those who don’t have the time or expertise to analyze individual stocks, there are other options to consider. Active mutual funds or index funds provide an opportunity to invest your money. Taking the Nifty 50 index as an example, it is a benchmark index consisting of the 50 largest Indian companies listed on the National Stock Exchange. The Nifty 50 index, since its inception, has provided an average annual return of close to 12% and an average dividend yield of 1.5%.

Investors can select the approach that aligns with their risk tolerance and investment goals, whether it’s investing in specific dividend stocks or utilizing mutual funds or index funds for more diversified exposure to the market.

Private equity investing

Private equity investing is a type of investment strategy where individuals invest in private companies or startups that are not publicly traded on a stock exchange. These companies require significant capital for their expansion and growth, and they often seek funding from private equity investors.

Private equity investing can be an attractive option for individuals who are looking to invest in a potentially profitable business but do not necessarily want to start one from scratch. This type of investment can come with a higher risk profile, but it can also offer the potential for high returns.

Typically, private equity investing requires a significant capital investment. The minimum investment amount can range from lakhs of rupees to several crore rupees, depending on the opportunity and the investor’s specific goals and needs.

While private equity investing can offer high returns, it is important to keep in mind the potential risks. Private companies and startups can be volatile, and it is not uncommon for them to fail. Investors need to be willing to accept the risk of losing their investment capital.

Farmland

Millennials seeking a slower, more peaceful lifestyle are increasingly showing interest in farmland as an investment option.

There are various income-generating opportunities associated with farmland investment.

One option is to actively participate in farming activities by cultivating the land, growing crops, and selling the produce in the market. The profitability of this approach largely depends on the type of crops grown and market conditions.

Another option is to lease the farmland to a farming company, which provides a predictable return on investment. By leasing the land, individuals can generate income without directly engaging in farming operations.

Investing in Real Estate Investment Trusts (REITs) specializing in farmland is another avenue for generating income. By investing in these REITs, individuals can indirectly participate in the farmland market and earn returns through the rental income and appreciation of the farmland properties.

Farmland investment allows individuals to combine their passion for a simpler lifestyle with the potential for financial returns. Before making any investment decisions, it is essential to research and understand the local agricultural market, assess the risks involved, and establish realistic expectations regarding income and profitability.

Cryptocurrency

Cryptocurrency is a modern digital asset class that operates on blockchain technology.

There are various avenues for making money through cryptocurrencies. These include trading for profit, long-term investment strategies, mining for new tokens, participating in staking activities, and engaging in Initial Coin Offerings (ICOs) or token sales.

Investors should be aware of the risks associated with cryptocurrencies, such as market volatility and regulatory uncertainties, and conduct thorough research before investing.

Bottom Line

Successful individuals often understand the importance of having multiple sources of income to ensure financial stability and achieve long-term wealth. By diversifying their income sources through various assets, they can mitigate risks associated with relying solely on a single income stream.

Regardless of your age or lifestyle, it is recommended to begin investing in such assets. By conducting thorough research and selecting the appropriate assets, you can establish a solid financial foundation for yourself. By conducting thorough research, selecting the right assets, and managing risks effectively, you can build a solid financial foundation and increase your chances of long-term financial success.

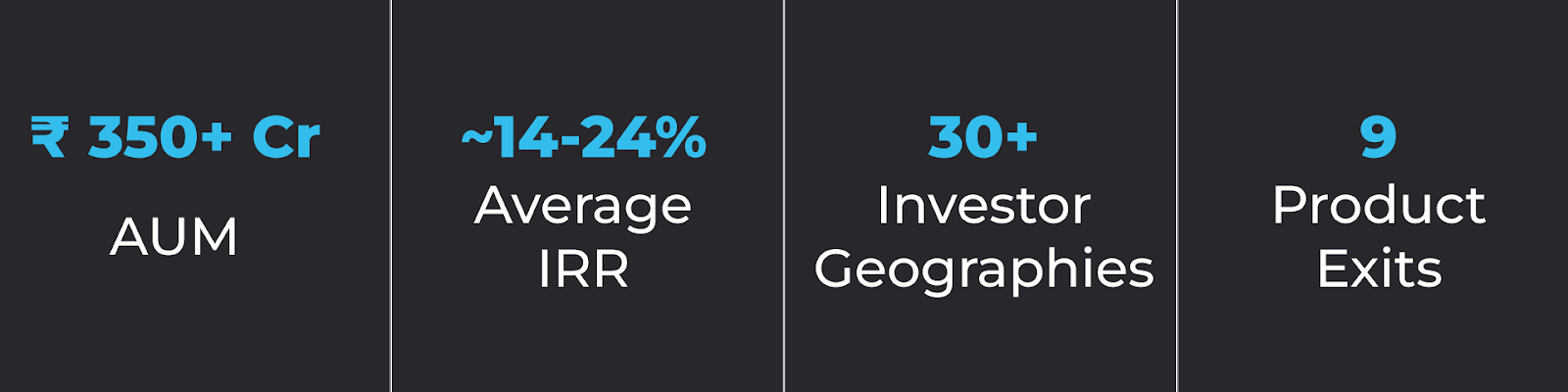

Assetmonk is a pioneer in alternative real estate investment, and we understand the immense potential in the Indian commercial real estate industry. We make alternative assets, such as real estate, more accessible.

We have customized investment options to suit individual financial goals like passive income capital appreciation and portfolio diversification. Our expertise is identifying opportunities with high yields within the retail, office, and industrial asset classes. This enables our investors to maximize profits while diversifying their portfolios.

We offer various alternative investment options, such as fractional or joint ownership of high-end commercial properties, sub-leasing ventures, etc. Trophy locations with the potential for high Internal Rates of Return (IRR) are prioritized, and due diligence is done to ensure these provide profitable returns for our investors.

FAQs

Q1. Which income generating asset has the highest return?

A. The profitability of an asset is determined by its holding period and the level of associated risk. The general principle is that “the higher the risk, the higher the potential returns.” Assets such as cryptocurrencies, stocks, and private equity investing can offer significant rewards, but they also carry greater risks.

Emerging investment opportunities in real estate in the form of fractional ownership and Real estate structured debts offer investors high returns and are comparatively carry a low level of risk.

Q2. What is the safest asset to invest in?

A. Real estate is considered a very safe investment. This is because it involves owning physical properties, like houses or buildings, which tend to go up in value over time. You can also make money by renting out these properties to others. Since there’s a limited amount of land available, the value of real estate often goes up as more people want to live or work in certain areas. While no investment is completely risk-free, real estate offers a level of security that makes it an attractive option for many investors.

Listen to the article

Listen to the article